Sold Merchandise on Account Terms 2/10 N/30

Kelp issuing invoice no. Scully Company sold merchandise on account to Burton Co 12000 terms FOB shipping point 210 neom.

Solved May 1 Paid Rent For May 5 000 3 Purchased Chegg Com

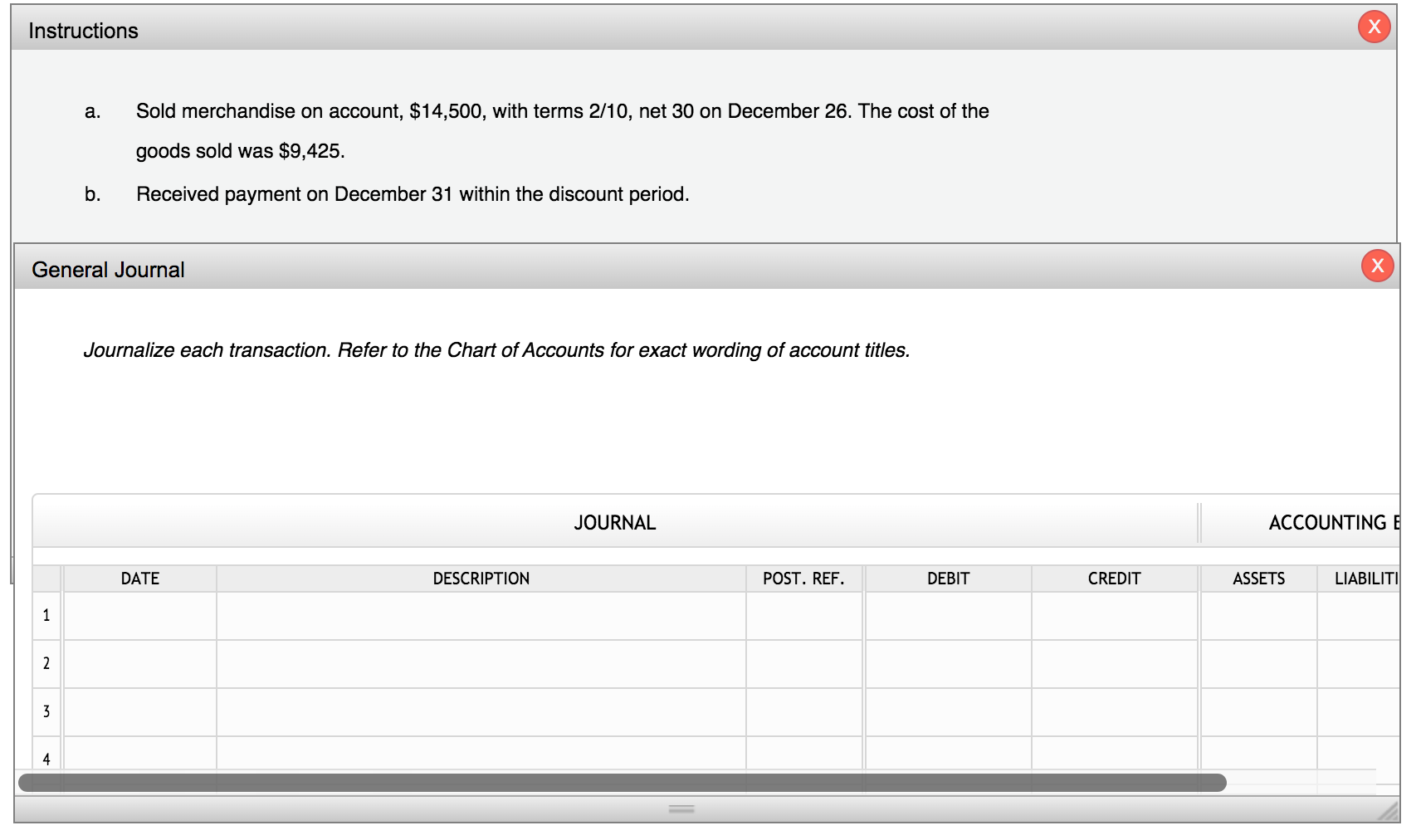

The initial journal entry for the sale will include a acredit to Sales for 14700.

. Ccredit to Merchandise Inventory for 15000. The company uses a perpetual inventory system. The merchandise sold had a cost of 2000.

Purchased merchandise from Lumley Inc. Purchased golf discs bags and other inventory on account from Mumford Co. Customers returned merchandise that had been sold for 1000.

Sold merchandise that cost 6000 to a customer on account for 9000 under terms 210 n30. The cost of the merchandise sold was 3300. From sale on May 22 1480.

Received credit from Black Wholesale Supply for merchandise returned 200. 10 Purchased merchandise from Torres Company terms 210 n30. The customer returned 500 worth of slightly damaged merchandise to the retailer and received a full refund.

Made refunds to cash customers for defective merchandise 70. Guardian Corporation recorded a sale on account for 15000 under the gross method of accounting for sales discounts with payment terms of 210 n30. Sold merchandise on account for 900 terms n30the merchandise sold had a cost of 540.

For 1000 terms 210 n30. The cost of the merchadise sold was 3300. Paid freight of 2400.

Sold merchandise on account 1000 terms n30. Sold merchandise on account for 4400 terms 210 n30. The retailer returned the merchandise to its inventory at a cost of 130.

Transactions for Buyer and Seller Shore Co. FOB shipping point P100000 including freight cost of P2500 paid by Torres Company. 29 Made refunds to cash customers for defective merchandise 70.

Garden Company refunded Mamouth Industries 900 for returned merchandise. Received credit from Mumford Co. On june 24 payment is received from eng co.

For merchandise returned 100. 620 FOB destination terms 210 n30. The company uses a perpetual inventory system.

Debit Cost of goods sold 58000. The cost of the merchandise sold was 980. The cost of the merchandise sold was 1400.

On june 20 eng co. 12 Paid Torres Company for purchase on March 2. A company sold merchandise for 1000 on account with terms of 210 n30.

Returns merchandise worth 300 to kersee company. The term 210 n30 is a typical credit term and means the following. Sold merchandise on account to a customer for 80000 terms 210 n30.

The selling price was 35000 with terms 210 n30. 1200 FOB shipping point terms 210 n30. 27 Paid Amland Distributors in full less discount.

Journalize the entry to record the receipt of payment beyond the discount period of ten days. Also accounted for receipt of the merchandise inventory at cost. Garden Company sold merchandise to Mamouth Industries on account for 3450 with terms 210 n30.

2 shows the discount percentage offered by the seller. Credit Merchandise 58000 2. 6 Issued credit memo to B.

Account paid in full. Scully Company pre-paid freight of 500 which was added to the invoice. Bdebit to Sales for 300.

What is the amount of cash received on june 24. Sold 2450 of merchandise on credit cost of 1000 with terms 210 n30 and invoice dated January 5. The cost of the goods sold was 58000.

The cost of the goods sold is 67200. Uses the net method under a perpetual inventory system. Add Freight 41650 375 42025.

The returned merchandise had a fair value of 30. This means that if the buyer pays their bill before the ten days period they will get a 2 discount. Paid Valley Distributors in full less discount.

Defective merchandise of 200 was returned 2 days later. Journalize the entries for Statham Co. Explanation of 210 n30 credit terms.

2 discount if paid within 10 days net amount due within 30 days. For the balance due. On june 15 kersee company sold merchandise on account to eng co.

For the sale purchase and payment of amount due. Journalize the receipt of payment within the discount period. June 4 Aquino sold merchandise on account to Villar P182000.

This merchandise had originally cost Contours 700. Find Discount 2 42500 x 002 850 Step 3. Since the buyer paid before the ten days period they will get a 2 discount.

Journalize Sayers entries to record the sale. The cost of the merchandise sold was 1750. Sold merchandise to Blue Star Co.

Received merchandise returned by Comer Co. If the buyer pays the bill after the ten days period but before thirty days they will pay the full amount. On account 112000 terms FOB shipping point 210 n30.

Debit Receivable Accounts 78400. The merchandise sold had a cost of 2000. Additionally if we use the perpetual inventory system it will also result in the increase of the cost of goods sold on the income statement as well as the decrease of the asset which is the merchandise inventory on the balance sheet on.

The cost of the merchandise sold was 7200. The returned merchandise had a fair value 31 Sold merchandise on account 1000 terms n30. Seller - Accounts receivable--Burton Co.

The cost of the merchandise sold is 88600. The remaining receivables were collected after the discount period had expired. Dr Accounts Receivable 4400 Cr Sales 4400 Cr Cost of Goods Sold 3300 Dr Merchandise Inventory 3300.

Purchased merchandise on account from Black Wholesale Supply for 8000 terms 110 n30. 11 Received freight bill from LBC Express for sale to Mr Ocampo on March 7 P1500. Journalize Sayers entries to record the sale.

Guardian paid 10500 for the merchandise. Shore paid freight of 1800. The cost of the returned merchandise was 600.

Indication 210 n30 or 210 net 30 on an invoice represents a cash sales discount provided by the seller to the buyer for prompt payment. 501 for 1000 cost 680. The sold merchandise on account will result in the increase of both total revenues and total assets on the day of selling the merchandise.

Sold merchandise on account to Comer Co 3480 terms 210 n30. On account 147600 terms FOB shipping point 210 n30. The cost of merchandise sold was 1850.

Sold merchandise for cash 4350. EE 6-5 Statham Co. 2 Sold merchandise inventory on account terms n30 to B.

Paid freight on the Mumford purchase 50. Sold merchandise to Bloomingdale Co. Credit terms of 210 n30 means that 2 discount for the payment within 10 days and the full amount to be paid within 30 days.

25 Purchased merchandise from Horvath Inc. Journalize Shore Cos entry for the sale purchase and payment of amount due. The cost of merchandise sold was 600.

The cost of the merchandise sold. Merchandise Price - Returns and Allowances 44900 - 2400 42500 Step 2. 1 Purchased merchandise on account fron Hauke Wholesale Supply for 8000 terms 110 n30 Dr Merchandise Inventory 8000 Cr Accounts Payable 8000 2 Sold merchandise on account fpr 44000 terms 210 n30.

Kelp for 1000 for merchandise returned to the business by the customer. 620 FOB destination terms 210 n30. Purchase Total - Discount 42500 - 850 41650 Step 4.

Solved Instructions A Sold Merchandise On Account 14 500 Chegg Com

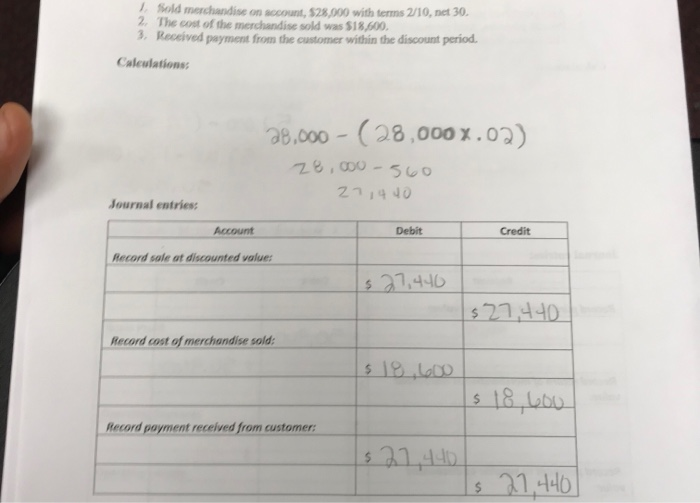

Solved J Sold Merchandise On Account 28 000 With Terms Chegg Com

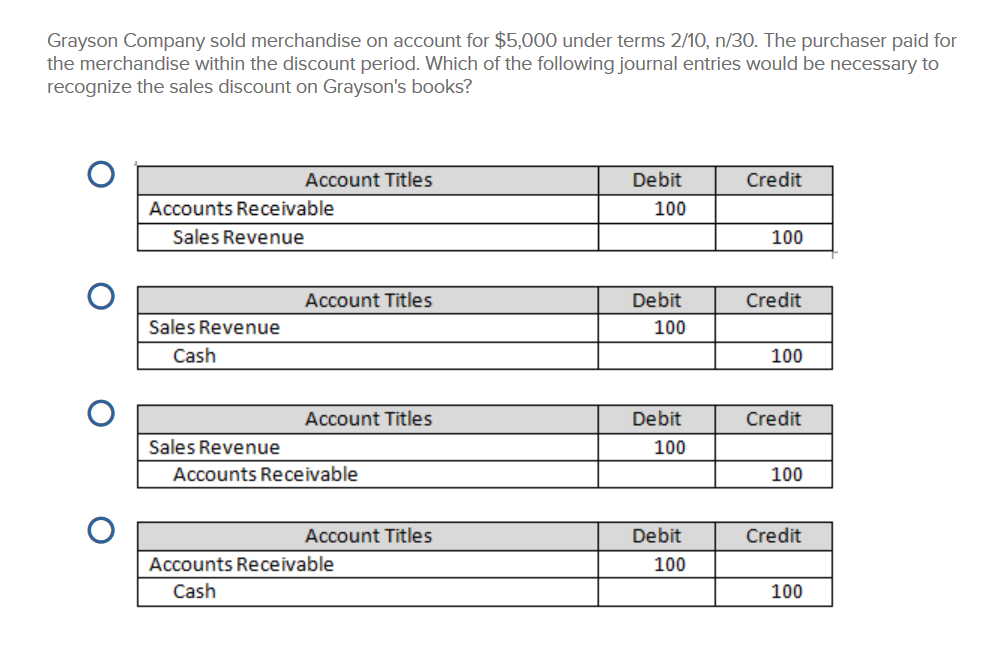

Solved Grayson Company Sold Merchandise On Account For Chegg Com

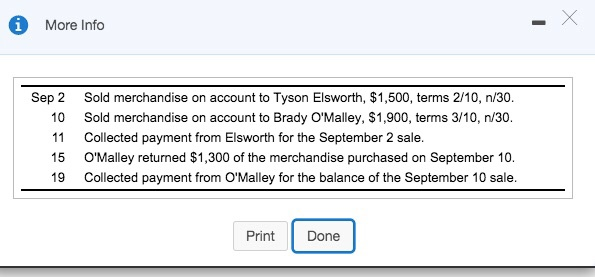

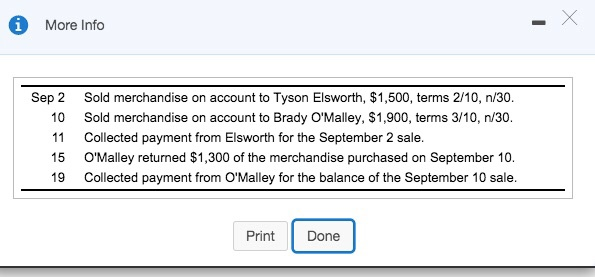

Solved More Info Sep 2 10 11 15 19 Sold Merchandise On Chegg Com

0 Response to "Sold Merchandise on Account Terms 2/10 N/30"

Post a Comment